Using Mobile Money

Michael V. McKay, Senior Software Developer

(updated February 2016)

NAIROBI, Kenya — With 74 percent of residents owning a mobile phone, Kenya is home to the world’s most widely used mobile money system, Safaricom’s M-PESA. A 2013 survey showed that 68 percent of Kenyans used mobile money within a 90-day period, and that 99 percent of active mobile money account holders use M-PESA.* Transactions vary widely—from sending money to family in rural areas, to paying for food at a restaurant, to paying electricity bills.

RTI International uses M-PESA to administer staff advances, vendor payments, and workshop allowances as part of our Primary Mathematics and Reading Initiative (PRIMR) programs in Kenya. In September 2014, we used M-PESA to pay 2,270 teachers working at 34 training sites at a cost of just $0.35 per teacher/transaction. The success of this venture led RTI to develop an interactive SMS system called Gooseberry, which streamlines the registration and payment process via M-PESA.

Gooseberry Delivers Quality Data, Ease of Use

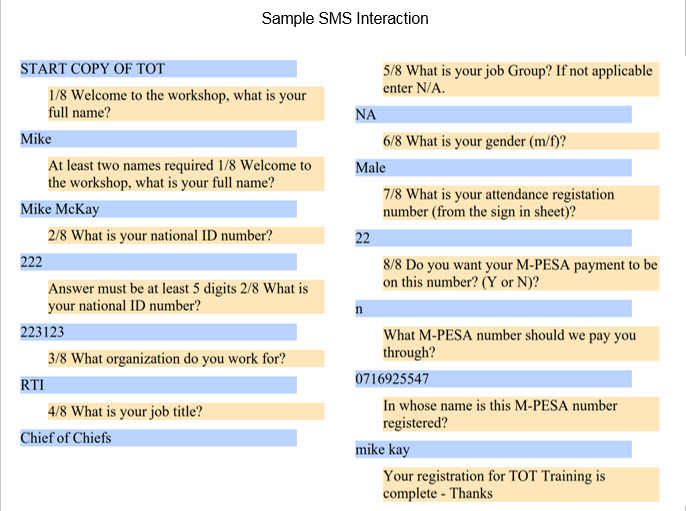

Gooseberry is a web application that facilitates SMS interactions. It was initially built to to register people attending training courses in rural Kenya. Guided by Gooseberry, trainees send SMS messages containing information necessary for payment via M-PESA. In addition to typical registration data such as name and mobile number, it also allows participants to specify that the money should be sent to someone else if they don't have a phone or an M-PESA account. In the following example, the blue boxes show the messages sent by a typical user, while the other boxes show the response from Gooseberry.

The data sent by the trainee is available on the Gooseberry website as soon as it is received and may be downloaded as a spreadsheet. Gooseberry also analyzes data (e.g., average completion time) and identifies problematic questions (e.g., where validation has failed). The spreadsheet is then sent to M-PESA to validate that names and phone numbers match the target M-PESA accounts. In addition, RTI checks for signatures on paper forms before submitting the final payments, via spreadsheet, to M-PESA.

Results

Gooseberry has now captured registration data from over 155,000 unique teachers throughout Kenya. Each teacher sent or received around 20 SMS, for a total of over 3 million SMS processed by the system. The majority of the trainings took place during two separate two week periods. During peak usage, gooseberry was handling about 6 messages per second.

Gooseberry has since been expanded for use beyond registration tasks. It captures malaria case notification and rainfall reports in Zanzibar as well as school field reports in Kenya.

Weighing the Pros and Cons

Gooseberry offers many benefits. For example, we estimate an approximately 75 percent reduction in administrative cost (e.g., vehicles, security). Also, there is transparency throughout the transaction chain, and payment time has been reduced from weeks or even months to just a few days.

There are also challenges. Transaction costs can be prohibitive for the end user to withdraw cash funds from an agent; it can be difficult to find an agent in some areas; and agents may not have enough cash to cover a user’s withdrawal request. Network coverage can also be a problem.

Overall, Gooseberry has proven to be a useful and cost-effective tool for our PRIMR operations in Kenya. We plan further enhancements to more closely integrate the process of spreadsheet creation and submission to M-PESA and to use electronic images of registration papers to validate signatures.

*Source: Financial Inclusion Insights, Kenya. (n.d.). Retrieved February 18, 2015, from http://finclusion.org/country-pages/kenya-country-page/

- Login to post comments

- Printer-friendly version

PDF version

PDF version